An RPA Case Study on Accounts Payable

Accounts Payable Case Study using Automation

In this blog I am discussing how one can use RPA to automating Accounts Payable (Invoice) processing. This is a very common example that occurs in almost every organization. So without further ado, let’s get into the nuts and bolts of it.

Let us start by defining the requirements:

A centralized team was involved in manual processing of around 5000 invoices a month using various tools and applications. To reduce manual errors and cut down the time taken for invoice processing, Below are the key KPI’s.

- Automate the invoice creation process for the dispatched policies

- Reduce Full Time Equivalents (FTEs) for resources to be efficiently utilized in process improvements, rather than task repetition

Now let us look at some of the challenges faced by the Accounts Payable department:

- Unstructured data -Scanned copy of invoice images that were sent in a PDF document format

- Duplicate invoices

- Non – standard documents – Different formats of invoices

- Errors, exceptions, approvals and workflows

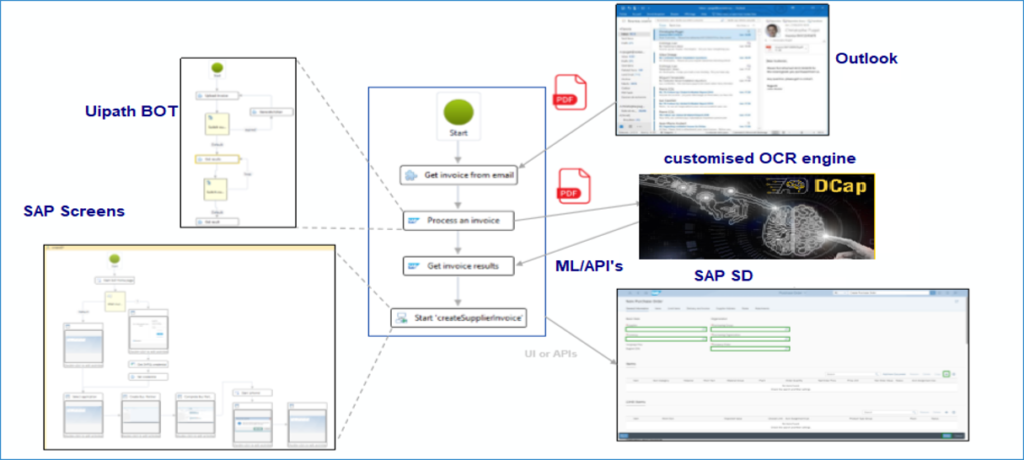

Let us look at how an intelligent AP Invoice Processing looks like

The Key Take Away for this are the following:

- Automated invoice matching of PO-based invoices

- Integrated invoice scanning software

- Shortens your invoice processing lead time to as little as 5 minutes per PO

- Gives you end-to-end visibility of the invoice process, from reception to payment through detailed logs

- Removes complexity in every step of the workflow – increasing productivity and reducing operating costs

- Boosts internal engagement with an exceptional user experience

- Provides comprehensive analysis and insights into your financial data – allowing you to report on time and with confidence

- The manual process was taking up to 10 to 12 mins for each transaction after automating the time taken has now reduced to 5 to 2mins to complete the transaction and send the logs to the stakeholder

Authored by Vijay Chander – All rights reserved 2023